30+ mortgage interest limitations

As noted in general you can deduct the. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Why Choose A 15 Year Over 30 Year Fixed Rate Mortgage

See how a land purchase would impact your bottom line.

. Web If your home was purchased before Dec. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately of. Save Real Money Today.

Ad Reviews Trusted by 45000000. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Youll pay more every month with a 10-year. Compare Top Home Equity Loans and Save. Web Home Mortgage Interest Limitations.

A basis point is. Ad Get fixed interim-fixed variable or adjustable rates plus flexible payments. In the year you.

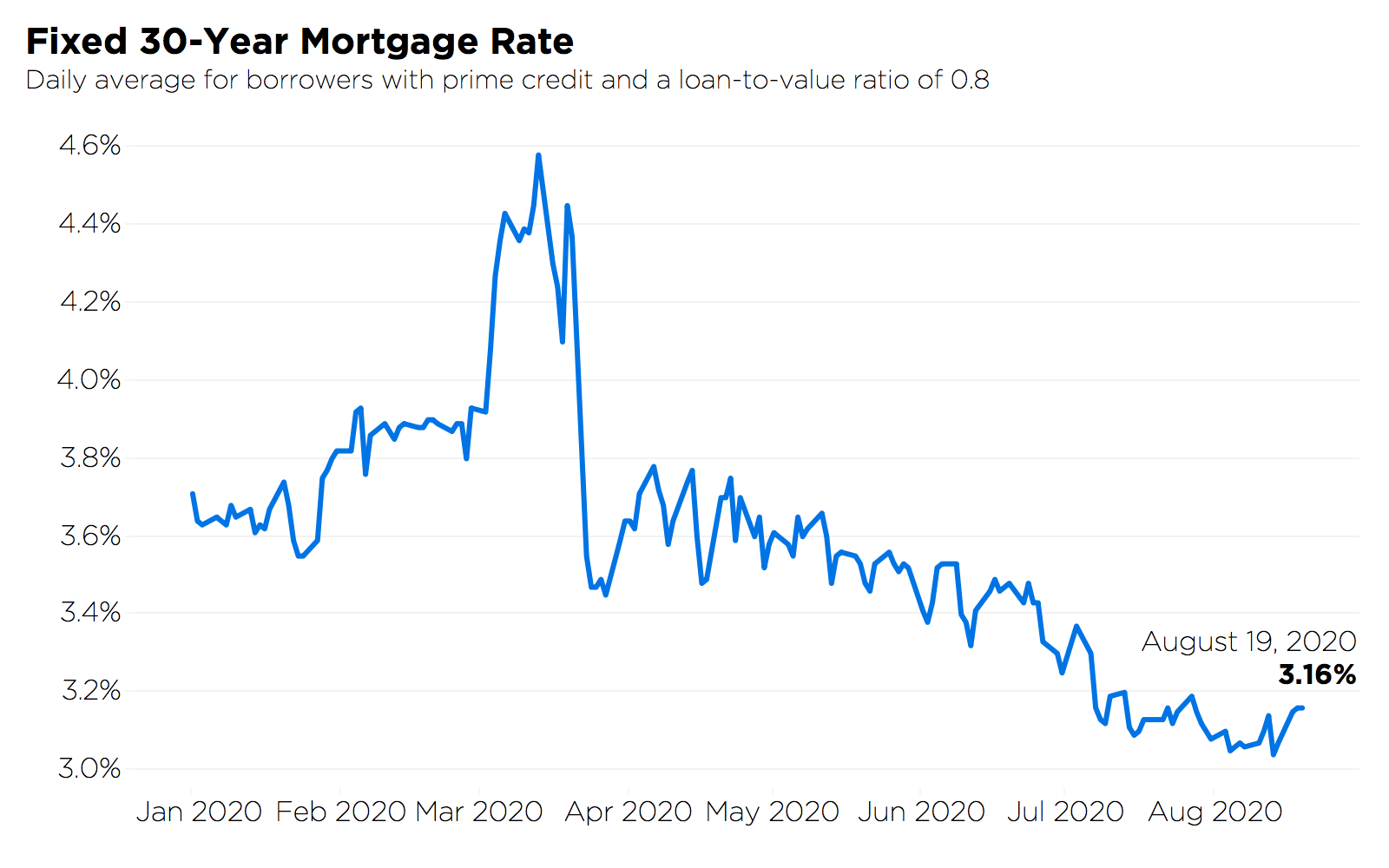

Web How much mortgage interest can you deduct in 2020. Call or apply online. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

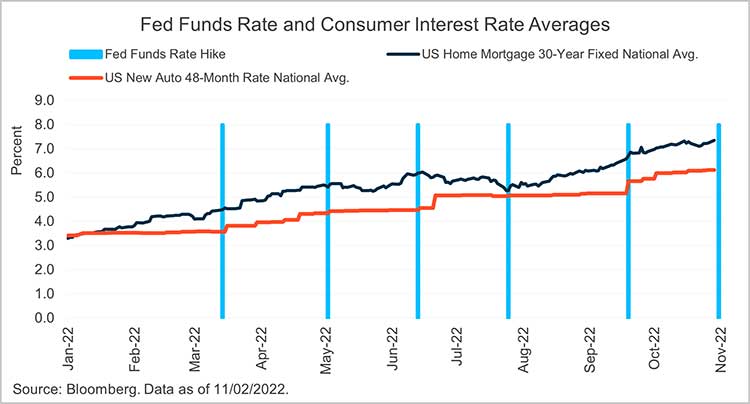

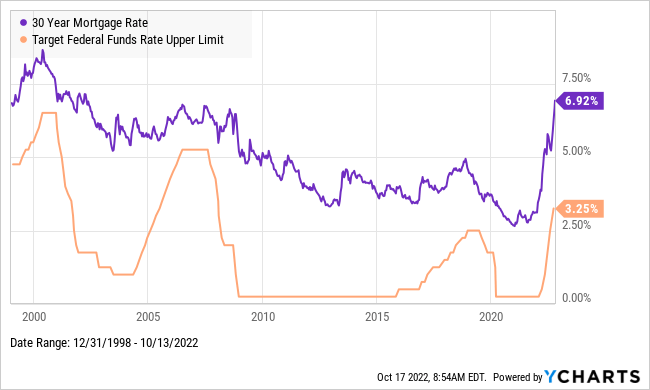

Web For a 30-year fixed-rate mortgage the average rate youll pay is 696 which is an increase of 24 basis points compared to one week ago. VA Loan Expertise Personal Service. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017.

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. Web For 2022 the limit is the mortgage interest paid on the first 750000 of indebtedness for a married couple or 375000 if single or married filing separately. Under Tax Cut and Jobs Act for tax years.

Contact a Loan Specialist. Trusted VA Loan Lender of 300000 Veterans Nationwide. Web Taxpayers who took out a mortgage after Dec.

For married taxpayers filing separate returns the cap. We Make Finding A Home Equity Line of Credit Easier - Compare Lenders Side-by-Side. Ad Reviews Trusted by 45000000.

Web 1 day agoA year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Web The Sec. Web So if you have a mortgage keep good records the interest youre paying on your home loan could help cut your tax bill.

For corporations that are partners in a partnership or members of a limited. It was 611 this time last week. Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid.

Web 17 hours agoThe APR on a 15-year fixed is 632. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. 17 following stronger-than-expected retail.

Web 16 hours agoThe current average interest rate for a 10-year refinance is 648 an increase of 38 basis points over last week. Web How to use equity in your home and bypass the 750K Mortgage Interest Limitation Heres whats happening. Fast VA Loan Preapproval.

For the 2020 tax year the mortgage interest deduction limit is 750000 which means homeowners can. 163 j limitation applies to any interest properly allocable to a trade or business. Web 18 hours agoThe average contract rate on a 30-year fixed-rate mortgage jumped by 23 basis points to 662 for the week ended Feb.

Web The refinanced debt term can be for 22 years or less for the mortgage interest to be fully deductible under the grandfather rules. If the taxpayers mortgage interest deduction must be limited due to the amount or nature of the loans enter the mortgage information in. Get Your VA Loan.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. We Make Finding A Home Equity Line of Credit Easier - Compare Lenders Side-by-Side. Web In light of this trade-off many countries have adopted thin-capitalization rules which typically limit the net interest deduction to 30 percent of earnings before.

At todays interest rate of 629 a 15-year fixed-rate mortgage would cost approximately. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Compare Top Home Equity Loans and Save.

Mortgage Rates Are At Record Lows Here S What That Means For You Zillow Group

Mortgage Overpayment Calculator Pay Off Your Debt Early

The Home Mortgage Interest Deduction Lendingtree

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

15 Year Vs 30 Year Mortgage Calculator Calculate Current 15yr Frm Or 30yr Monthly Fixed Rate Mortgage Refinance Payments

Another Piece Of The Puzzle Of Plunging Credit Card Balances Wolf Street

Fed Tools And The Terminal Rate Silicon Valley Bank

How To Compare Mortgage Lenders Interest Rates Veteran Com

The More You Panic The More I Buy Seeking Alpha

Rates Charges Commerzbank

Inflation Rises To 11 1 What Next For Base Rates And Mortgage Rates In 2023 And Beyond Moneysavingexpert Forum

Free 9 Mortgage Payment Calculator Templates In Pdf

Is There A Point At Which Having Too Many Credit Cards Negatively Impacts Your Credit Quora

Buy A House Lisa Legrande Mortgage Loan Officer

Tax Refund Chip Jewell Mortgage Loan Officer

Mortgage Interest Deduction Rules Limits For 2023